Tax Areas

How Can We Help You?

No matter where you reside – you must file. All US citizens and Green Card holders must (if they meet minimum filing thresholds) file an annual tax return reporting their worldwide income.

Filing is required – but you likely won’t owe anything.

The good news is that most expats don’t end up paying any taxes to the IRS. There are a plethora of tax deductions which we will utilize that allow taxpayers to deduct more than $100,000 from their taxable income. But – in order to receive these generous exclusions and deductions – you must continue to file. Failure to do so can lead to penalties.

As a US citizen living abroad, your tax filing requirements are basically the same as…

02.

Over the years, we have helped hundreds of small business clients get their…

03.

US estate tax is assessed on the value of the decedent’s assets at the time of…

04.

Have you accumulated more than $10,000 in foreign banks or financial institutions?……

05.

There is really no need to fret, we are here to help, even if you are filing your taxes…

07.

08.

.

Get Started with Your Case

Call us: +1 123 456 7890

Individual Tax Returns

US citizens living have the same tax filing requirements as citizens living in the United States. So you need to file a Federal return, for sure, and possibly a State and City return, as well. We can help you with all returns you need, no matter how complex.

02.

Business Tax Returns

SMALL BUSINESSES can have big questions, and oftentimes finding the right answers can be challenging.

Luckily, our small business professionals can offer you outstanding business consulting and tax preparation services.

Over the years we have helped hundreds of small businesses get off the ground through our help with entity selection, government applications and reliable suggestions. Take advantage of our small business expertise by contacting us today.

We do all businesses…US Corporations, Foreign Corporations, Partnerships, LLC’s.

03.

Estates and Trusts

There are several important factors used to determining the taxability of an US estate or trust: taxable gifts, related expenses, charitable contributions, life insurance, annuities, and marital deductions.

04.

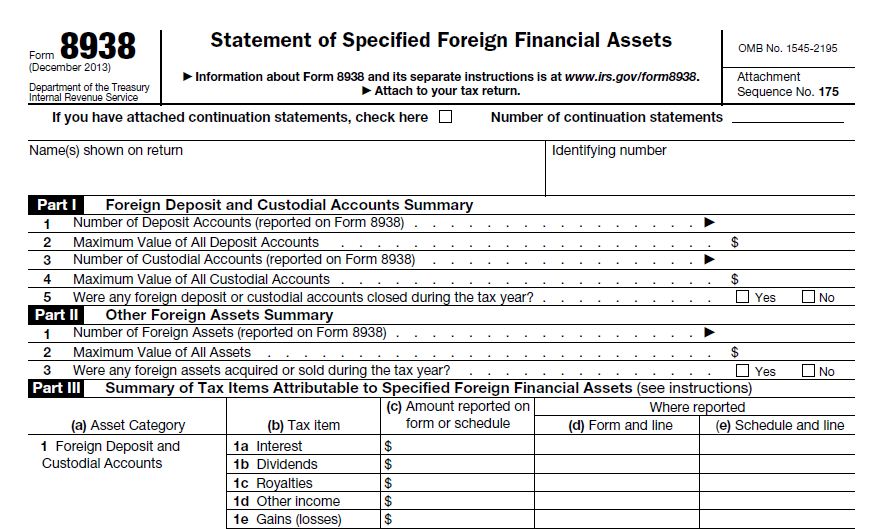

FBARS and FORM 8938

If your answer is “yes”, you are required to submit a yearly report of your foreign bank and financial accounts to the US Department of Treasury. This report is commonly referred to as an FBAR (Foreign Bank Account Report).

05.

Estates and Trusts

US estate tax is assessed on the value of the decedent’s assets at the time of death. There are several important factors used to determining the taxability of an US estate or trust: taxable gifts, related expenses, charitable contributions, life insurance, annuities, and marital deductions.